na-sutki-39.ru

Market

House Warranties

:max_bytes(150000):strip_icc()/AmericasPreferredHomeWarranty-c9ec01d0b7ff4745b64357100cae327d.png)

A home warranty from Home Buyers Warranty is a service contract that helps you protect more systems and appliances and pay less. A home warranty can help cover repair or replacement costs when normal wear and tear takes its toll. Learn about home warranties and choose the best plan to secure your home and budget from unforeseen home system and appliance repairs with ORHP! A home warranty is a contract between a home protection company (aka “home warranty company”) and a homeowner in which the warranty company promises to repair. A home warranty is a contract between a homeowner and a home warranty company that provides for discounted repair and replacement service on a home's major. A home warranty covers plumbing issues, like clogs and leaks, but not damage that leaks cause to drywall, flooring, or other structural parts of the home. Some. Our home warranty plans cover everything from appliances to plumbing, electrical systems, heating and air conditioning. How a home warranty works. A First American home warranty is a service contract that protects a home's systems and appliances from unexpected repair or. What is a home warranty? A home warranty plan protects the appliances and systems in your home: major home appliances, electrical, plumbing, and HVAC systems. A home warranty from Home Buyers Warranty is a service contract that helps you protect more systems and appliances and pay less. A home warranty can help cover repair or replacement costs when normal wear and tear takes its toll. Learn about home warranties and choose the best plan to secure your home and budget from unforeseen home system and appliance repairs with ORHP! A home warranty is a contract between a home protection company (aka “home warranty company”) and a homeowner in which the warranty company promises to repair. A home warranty is a contract between a homeowner and a home warranty company that provides for discounted repair and replacement service on a home's major. A home warranty covers plumbing issues, like clogs and leaks, but not damage that leaks cause to drywall, flooring, or other structural parts of the home. Some. Our home warranty plans cover everything from appliances to plumbing, electrical systems, heating and air conditioning. How a home warranty works. A First American home warranty is a service contract that protects a home's systems and appliances from unexpected repair or. What is a home warranty? A home warranty plan protects the appliances and systems in your home: major home appliances, electrical, plumbing, and HVAC systems.

Home warranties help protect your home from unexpected repairs. When something breaks down, you can file a claim with the warranty company, and they'll assign a. Home warranty plans cover breakdowns and malfunctions of home systems and appliances due to normal wear and tear. A home warranty has the potential to save you thousands of dollars when covered systems or appliances fail. Our single-family home warranties help protect 24 major home systems and appliances, giving you peace of mind during unexpected breakdowns or malfunctions. Read reviews of the best home warranty companies of from U.S. News & World Report. Find out which home warranty plans are the best for you. Below is an overview of the different levels of our limited warranty. 1 Year Coverage All Materials and Workmanship (except landscaping). The average basic home warranty prices range from $ to per year and extended coverages add $ to $ to that yearly figure. Each repair has a service. Our home warranties help cover the cost of repairing or replacing major home appliances and systems, helping you stay on budget and limit downtime. A home warranty is a contract that agrees to provide a homeowner with discounted repair and replacement services. However, the words "home warranty" are not. Home warranties are similar to insurance policies or service contracts which cover products and structural elements of a residential building. A home warranty is an annual contract that covers the repair or replacement of major appliances and home systems. Builder warranties for newly built homes generally offer limited coverage on workmanship and materials for specific components of the home, like windows. Cinch Home Services is a home warranty company serving over 1m customers yearly, with over 45 years of experience of protecting homeowners. With prices starting at $ per month, American Home Shield protects your budget by beating the national average home warranty cost of $ to $ a. Home warranty plans cover the repair and replacement of your home's major systems and appliances when they wear out. There are three primary types of home. Fidelity National Home Warranty - Order a home protection plan from Fidelity National Home Warranty and enjoy peace of mind in your home. A home warranty is a one-year service agreement that covers the repair or replacement of some home system and appliances. Cinch home warranty plans cover cover 25 home systems and appliances due to normal wear. Our home warranty coverage is packaged as an appliance-only plan. A home warranty is a contract that covers the cost of maintaining household systems or appliances, not to be confused with homeowners insurance. Home warranty coverages will vary based on the plan you select, but can protect nearly all your home essentials—including optional coverage for pools and spas.

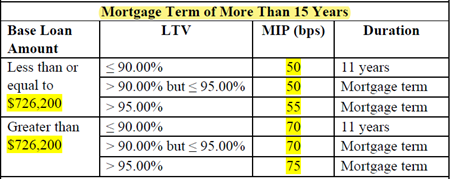

When Can You Drop Mortgage Insurance On Fha Loan

The good news is that you can request that your lender remove PMI once the principal balance of your loan reaches 80% of the original value of the property. To. For mortgages with an FHA case number assignment date on or after June 3, , the FHA insurance can be terminated by the servicer or holder if the mortgage is. The annual premium is also cancelled automatically on 15 year loans when the loan balance falls to 78 percent of the original value. There is no five year. For mortgages with terms greater than 15 years, the MMI will be canceled when the Loan-to-Value reaches 78%, as long as the borrower has been making payments. If your payments are current and in good standing, your lender is required to cancel your PMI on the date your loan is scheduled to reach 78% of the original. I've had a FHA mortgage for years. Can I take advantage of these new lower premiums? The change does not affect loans that have already closed. You may wish to. Depending on the FHA loan application date, there are different options for removing FHA monthly mortgage insurance, which will be discussed in this article. Mortgage Insurance (MIP) for FHA Insured Loan · MIP Rates for FHA Loans Over 15 Years. If you take out a typical year mortgage or anything greater than. PMI can be removed on an FHA mortgage is if you put 10%+ down payment down when you got it. It falls off around 11 years. The good news is that you can request that your lender remove PMI once the principal balance of your loan reaches 80% of the original value of the property. To. For mortgages with an FHA case number assignment date on or after June 3, , the FHA insurance can be terminated by the servicer or holder if the mortgage is. The annual premium is also cancelled automatically on 15 year loans when the loan balance falls to 78 percent of the original value. There is no five year. For mortgages with terms greater than 15 years, the MMI will be canceled when the Loan-to-Value reaches 78%, as long as the borrower has been making payments. If your payments are current and in good standing, your lender is required to cancel your PMI on the date your loan is scheduled to reach 78% of the original. I've had a FHA mortgage for years. Can I take advantage of these new lower premiums? The change does not affect loans that have already closed. You may wish to. Depending on the FHA loan application date, there are different options for removing FHA monthly mortgage insurance, which will be discussed in this article. Mortgage Insurance (MIP) for FHA Insured Loan · MIP Rates for FHA Loans Over 15 Years. If you take out a typical year mortgage or anything greater than. PMI can be removed on an FHA mortgage is if you put 10%+ down payment down when you got it. It falls off around 11 years.

Once you've built equity of 20% in your home, you can cancel your PMI and remove that expense from your monthly payment. If you're current on your mortgage. Mortgage Insurance (MIP) for FHA Insured Loan · MIP Rates for FHA Loans Over 15 Years. If you take out a typical year mortgage or anything greater than. You'll need to notify your lender that you want to remove your MIP if it hasn't already been canceled or if you've decided to refinance your mortgage loan. FHA. The annual premium is also cancelled automatically on 15 year loans when the loan balance falls to 78 percent of the original value. There is no five year. Unfortunately, it's only possible to remove the mortgage insurance from an FHA loan without refinancing if your loan origination date is after January 1, Depending on the FHA loan application date, there are different options for removing FHA monthly mortgage insurance, which will be discussed in this article. With an FHA loan, you will pay an upfront mortgage insurance premium (MIP) of percent. There is also an annual premium of to percent. Upfront. You can't cancel MIP payments on an FHA loan, but there are ways to avoid or lower your FHA MIP payment – like making a larger down payment or refinancing to a. How to Stop Paying FHA Loan Mortgage Insurance. For recent FHA loans, you will need to pay insurance premiums for at least 11 years, and you may need to pay. For year FHA loans with a down payment of 10% or more, you can cancel your monthly MIP after 11 years. Without putting down 10% or more on an FHA mortgage. It's canceled automatically after your equity reaches 78% of the purchase price. FHA mortgage insurance can't be canceled if you make a down. The LTV ratio is crucial in determining when you can eliminate MIP from your FHA loan. To calculate your LTV, divide your current mortgage balance by the lower. PMI is associated with conventional loans and can often be removed once you reach 20% equity in your home. MIP, on the other hand, is for FHA loans and has. Despite what you've heard, FHA MIP is not permanent. Some homeowners can simply let their mortgage insurance fall off; others need to refinance out of it. With. You usually cannot cancel PMI during the first two years of the loan and lenders may require that you have a history of on-time payments before it will cancel. The only way to eliminate the mortgage insurance payment on an FHA mortgage is to pay it off. If you are reluctant to deplete your financial. PMI is often interchanged with MIP. You can get rid of PMI on conventional loans, but you may not be able to eliminate MIP on FHA mortgages. Here's why. A down payment of less than 10% means that FHA mortgage insurance will remain for the life of the loan. You can remove the mortgage insurance by refinancing. How to Stop Paying FHA Loan Mortgage Insurance. For recent FHA loans, you will need to pay insurance premiums for at least 11 years, and you may need to pay. Freddie Mac (Conventional): Private Mortgage Insurance (PMI) will drop off once the loan balance reaches 78% of the original purchase price. FHA: Mortgage.

Can You Write Checks From An Online Savings Account

you to make credit and debit transactions. These accounts can offer both a debit card and check-writing capabilities. Withdrawals can take the form of cash. If you don't write checks and are looking for a completely electronic We can also combine your savings account statement with your checking account statement. The interest-bearing Platinum Savings account gives you several easy ways to get to your money when you need it, including online and mobile access. They must have routing and account numbers associated with them that can be entered on a tax return. Taxpayers should check with the mobile app provider or. Write checks from your account. FirstRate Money Market Learn more. Compare You can even take your funds with you if you ever leave your job. Savings with the option to write checks. Monthly service fee. $12 A savings account is a bank account where you can store your money and earn interest. While you cannot write checks from standard savings accounts, you can write checks from money market accounts. Checks written on a money market account count. Save yourself a trip to the bank by ordering checks online or through the Capital One mobile app. When it comes to comparing a checking vs. savings account, the main difference is that a checking account may allow you to write checks or make purchases and. you to make credit and debit transactions. These accounts can offer both a debit card and check-writing capabilities. Withdrawals can take the form of cash. If you don't write checks and are looking for a completely electronic We can also combine your savings account statement with your checking account statement. The interest-bearing Platinum Savings account gives you several easy ways to get to your money when you need it, including online and mobile access. They must have routing and account numbers associated with them that can be entered on a tax return. Taxpayers should check with the mobile app provider or. Write checks from your account. FirstRate Money Market Learn more. Compare You can even take your funds with you if you ever leave your job. Savings with the option to write checks. Monthly service fee. $12 A savings account is a bank account where you can store your money and earn interest. While you cannot write checks from standard savings accounts, you can write checks from money market accounts. Checks written on a money market account count. Save yourself a trip to the bank by ordering checks online or through the Capital One mobile app. When it comes to comparing a checking vs. savings account, the main difference is that a checking account may allow you to write checks or make purchases and.

Safely holds the funds you need for day-to-day expenses · Provides access to your money through a debit card, ATM or checks · Easily links to bills and other. May be used for writing a check, paying with a debit card, wire transfers, a money order, or ACH transfers; Mobile app and online account access; May or may. What do I need to apply for a personal account online? To be 18 years of age We provide Checking Accounts, Savings Accounts, CDs, Money Market Accounts. Despite their name, you can do more than simply write checks with a checking account. Today, banking with a checking account can be a foundational element of. account, or you might deposit checks at a bank's teller window or ATM Although electronic processing might mean that the check you write will. You can also deposit into your Marcus savings account by check. Please make the check payable to your name (make sure the name is the same as on the account) or. It is very important to remember that a checkcard acts like an electronic check, and funds are automatically deducted from your account. Sometimes, though, you. Checking accounts are held through a financial institution, like a bank or credit union, and are a place to deposit money, make transfers, write checks. All Navy Federal checking accounts come with free name-only checks. Here's how to order Choose either Checking or Money Market Savings Account from the. If you don't write checks and are looking for a completely electronic We can also combine your savings account statement with your checking account statement. Can I write checks from my savings account? Unlimited check writing is available with Key Select Money Market Savings®, Key Silver Money Market Savings® and. How do checkless checking accounts work? · Deposit and withdraw funds in person, online, or at an ATM · Have access to money orders, cashier's checks, and online. account, or you might deposit checks at a bank's teller window or ATM Although electronic processing might mean that the check you write will. You can access money in a checking account with a check, at an ATM or through electronic debits. Most checking accounts don't pay interest, although a few high-. For example, savings accounts do not use checks for payments and may be used for putting money aside to reach a savings goal. A Huntington savings account also. Allow you to write checks against the balance in your account · Enable you to access your money through an ATM or debit card · Are best used for day-to-day. Overdraft protection is there to protect you from returned checks and is a benefit of most OZK checking accounts. Instead of returning the checks, we will. How can we help you? Log in. Checking Accounts. Compare Checking And let's not forget where the name “checking account” comes from – writing checks! We believe that a check you deposit will not be paid;; You redeposit a check If we ask you to put your complaint or question in writing and we do. What do I need to apply for a personal account online? To be 18 years of age We provide Checking Accounts, Savings Accounts, CDs, Money Market Accounts.

Cost To Rent A Lamborghini For A Day

Yes, you can rent a Lamborghini at Exotics. You must have a valid driver's license. We can provide you coverage for the car, subject to manager's approval. MVP Charlotte specialize in exotic car rentals and have the best fleet in the area. Experience Charlotte in the Lamborghini that best fits your style. arent uruses usually like $ a day from an actual rental place? It probably depends on your income level and your willingness to pay for such a rental. These cars can cost upward of $k. Rent brand new Lamborghini's in Chicago. Take your pick of the Aventador, Huracan, or Urus. DS Luxury is the largest provider of luxury and exotic car. Looking for luxury car rentals in Ottawa? Latest prices: Budget C$ 75/day. Avis C$ 75/day. Turo C$ 84/day. Search and find Ottawa luxury car rental deals on. Rate is about $ a day and $10k deposit. Rich people from other country renting them for 2~3 weeks.. even months. There is definitely market. Affinity Luxury Exotic Car Rental - Toronto car rental - Find the best car rentals around the GTA - Owned and operated for over 25 years. The typical cost to rent a Lamborghini Huracan Spyder starts from $1, – $ per day with a security deposit of $ – $ They average allowable. Yes, you can rent a Lamborghini at Exotics. You must have a valid driver's license. We can provide you coverage for the car, subject to manager's approval. MVP Charlotte specialize in exotic car rentals and have the best fleet in the area. Experience Charlotte in the Lamborghini that best fits your style. arent uruses usually like $ a day from an actual rental place? It probably depends on your income level and your willingness to pay for such a rental. These cars can cost upward of $k. Rent brand new Lamborghini's in Chicago. Take your pick of the Aventador, Huracan, or Urus. DS Luxury is the largest provider of luxury and exotic car. Looking for luxury car rentals in Ottawa? Latest prices: Budget C$ 75/day. Avis C$ 75/day. Turo C$ 84/day. Search and find Ottawa luxury car rental deals on. Rate is about $ a day and $10k deposit. Rich people from other country renting them for 2~3 weeks.. even months. There is definitely market. Affinity Luxury Exotic Car Rental - Toronto car rental - Find the best car rentals around the GTA - Owned and operated for over 25 years. The typical cost to rent a Lamborghini Huracan Spyder starts from $1, – $ per day with a security deposit of $ – $ They average allowable.

Over 10 Lamborghini's available to rent on self drive hire. Nationwide delivery. Hire our stunning Lamborghini Huracan Spyder from just £ per day (based on a. As a rule, you can rent different Lamborghini models in Dubai at affordable prices. The average rental price of a Lamborghini is dirhams per day, and. Yes, you can certainly rent a Lamborghini Urus for just a day! Our exotic car rentals are designed to accommodate the unique needs of our clients, whether you'. How much is it to rent a Lamborghini Urus? The cost of your rental depends on the rental length, location, optional insurance products and add-ons. For. Lamborghini rental ranges from $1, up to $2, per day. It is one of the world's most renowned supercar manufacturers and they are among the most popular. Finally, Lamborghini Urus rentals offer flexibility. You can rent a Lamborghini Urus for a day, a week, or even a month, depending on your needs. Plus, with. It costs $ per day. We kindly ask you to see all payment information and car prices in our homepage or just call us! Besides, we want to let you. With prices starting from £* a day, isn't time you treated yourself to a piece of motoring luxury that oozes affluence and extravagance. Hire a Lamborghini. $ +GST per day Weekends ( KM Incl.) $ +GST per week ( KM Incl.) $ +GST per month ( KM Incl.) $4/. The cost of a Lamborghini rental depends on where you pick it up and how you plan to use it. Prices start at $1, per day for the Urus and $1, per day for. Veluxity Exotic Car Rental NYC offers a curated fleet of Lamborghini rentals available to the Greater New York area via our wide ranging network of hosts. You can rent a Lamborghini Huracan from Dream Charters for $ per day during the week, $ per day during the weekend, and $ for a 3 day weekend. We offer exotic sports cars, luxury sedans and SUVs, and have one of the largest selections of exotic and premium vehicle rentals available. At mph club, hour rental prices range from $ up to $25,! Here are the parameters that account for this staggering yet justifiable difference. How much is it to rent a Lamborghini Huracan? The cost of your rental depends on the rental length, location, optional insurance products and add-ons. Pickup at the airport Fiumicino (FCO), Ciampino (CIA), at your hotel, residential or business address in Rome at no additional cost. One-way luxury rental cars. Renting a Lamborghini Dubai is more cost-effective than most people imagine. Although clients expect to pay more for supercar rental, the cost is a great value. Lamborghini RentalLos Angeles ; Huracan EVO Spyder AWD · $ /day ; Huracan EVO Spyder · $ /day ; Urus Performante · $ /day ; Huracan EVO Discover the ultimate luxury car rental experience with Lux Exotic Rentals in Toronto, Ontario. Our exceptional fleet includes Lamborghini, Ferrari.

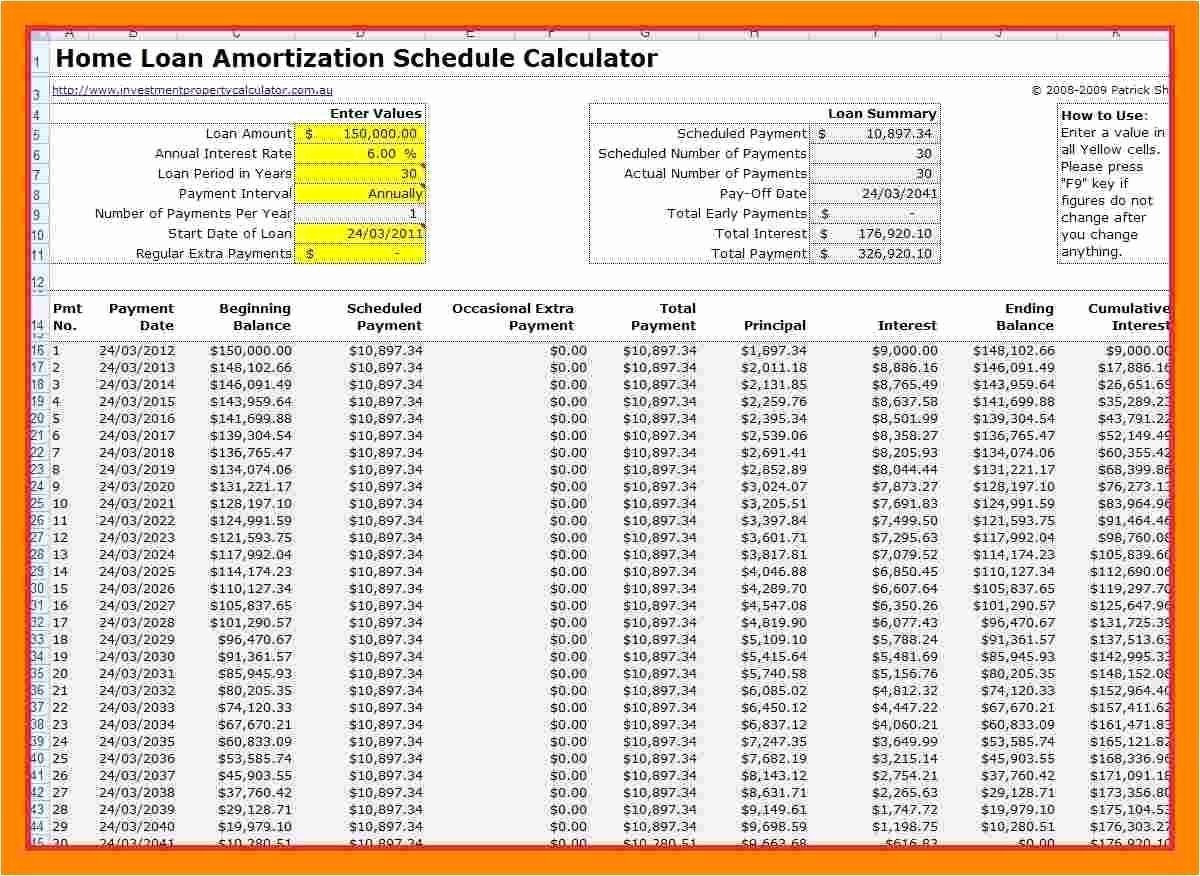

Amortization Chart For 15 Year Mortgage

This calculator will compute a mortgage's monthly payment amount based on the principal amount borrowed, the length of the loan and the annual interest rate. Year , $ 59,, $ , $ 41,, $ , $ 80, , $ 58,, $ , $ 41,, $ , $ 80, , $ 58,, $. An amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time. This amortized loan is then paid over a predefined period of time. In the case of mortgages, the time period is typically 15 to 30 years. Read more ▽. If. Use this Amortization Schedule Calculator to estimate your monthly loan or mortgage repayments, and check a free amortization chart. Our mortgage calculator reveals your monthly mortgage payment, showing both principal and interest portions. See a complete mortgage amortization schedule. Amortization Chart. Monthly Payment Per $1, of Mortgage. Rate. Interest. Only. 10 Year. 15 Year. 20 Year. 25 Year. 30 Year. 40 Year. Loan Calculator with Amortization Schedule. Print-Friendly, Mobile-Friendly. Calculate Mortgages, Car Loans, Small Business Loans, etc. An amortization schedule shows how the proportions of your monthly mortgage payment that go to principal and interest change over the life of the loan. This calculator will compute a mortgage's monthly payment amount based on the principal amount borrowed, the length of the loan and the annual interest rate. Year , $ 59,, $ , $ 41,, $ , $ 80, , $ 58,, $ , $ 41,, $ , $ 80, , $ 58,, $. An amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time. This amortized loan is then paid over a predefined period of time. In the case of mortgages, the time period is typically 15 to 30 years. Read more ▽. If. Use this Amortization Schedule Calculator to estimate your monthly loan or mortgage repayments, and check a free amortization chart. Our mortgage calculator reveals your monthly mortgage payment, showing both principal and interest portions. See a complete mortgage amortization schedule. Amortization Chart. Monthly Payment Per $1, of Mortgage. Rate. Interest. Only. 10 Year. 15 Year. 20 Year. 25 Year. 30 Year. 40 Year. Loan Calculator with Amortization Schedule. Print-Friendly, Mobile-Friendly. Calculate Mortgages, Car Loans, Small Business Loans, etc. An amortization schedule shows how the proportions of your monthly mortgage payment that go to principal and interest change over the life of the loan.

An amortization calculator helps you understand how fixed mortgage payments work. It shows how much of each payment reduces your loan balance and how much. An amortization calculator can show you how your principal and interest are paid over the life of your loan. Current Loan Amount: Term (in years). Or, enter in the loan amount and we will calculate your monthly payment. You can then examine your principal balances by payment, total of all payments made. This amortization schedule calculator allows you to create a payment table for a loan with equal loan payments for the life of a loan. This calculator will figure a loan's payment amount at various payment intervals - based on the principal amount borrowed, the length of the loan and the. The table below presumes both loans have a 20% down payment. Loan Details, year Fixed Mortgage, year Fixed Mortgage. Principal loan amount, $, Loan Amortization Schedule. Refinancing is how you change the schedule on which you're required to pay off the loan, say from 30 years to 20 or even Our mortgage amortization calculator takes into account your loan amount, loan term, interest rate and loan start date to estimate the total principal and. This vs. year mortgage calculator provides customized information based on the information you provide. But, it also makes some assumptions about. years in your loan term by For example, a four-year car loan would have 48 payments (four years × 12 months). Preparing Amortization Schedules. Amortization. Use this simple amortization calculator to see a monthly or yearly schedule of mortgage payments. Compare how much you'll pay in principal and interest and. The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan. It also calculates the monthly payment amount. Year Mortgage Amortization Schedule by Month ; 3. 1, , ; 4. 1, , Note: The spreadsheet is only valid for up to payments (year monthly, year biweekly, year weekly, etc.) Term of Loan in Years, 5, Total. A loan amortization schedule is calculated using the loan amount, loan term, and interest rate. If you know these three things, you can use Excel's PMT function. This amortization calculator shows the schedule of paying extra principal on your mortgage over time. See how extra payments break down over your loan term. Amortization calculators are especially helpful for understanding mortgages because you typically pay them off over the course of a to year loan term. You don't necessarily need to take a shorter loan term to pay off your debt faster. Remember you can pay off, for example, a year mortgage in 15 years by. Enter your loan term. In the Loan term field, enter the length of your loan — usually 30 years, but could be 20, 15 or Enter your interest. Year FixedAdjustable-Rate MortgageBorrowSmart AccessFHA LoanHomeReady Homeowners can calculate their mortgage amortization by using an online amortization.

Ripple News 1 Hour

RLUSD will be valued to the US dollar (USD) and % backed by US dollar deposits, short-term US government treasuries, and other cash equivalents. These. This is way faster than the 2 minutes plus for Ethereum, up to 1 hour or longer for Bitcoin and up to 5 days for traditional systems. The network can also. They Lied About XRP Now THIS Ripple News!. Molt Media. 21K views•6 days ago Ripple XRP price JUMPS 5% in just hours! Cheeky Crypto. K views•4. Super Bullish Ripple (XRP) Price Prediction, but Some Worrying Signs Appear. The cryptocurrency market exploded in the past 24 hours. Almost all of the. Recent news/opinions on the Ripple Network. August 7: In a significant 1 hour ago. Jito Price Prediction Will JTO Price Hit $10? Price / Market Value / Chart >; Ripple (XRP) Price Chart (XRP/JPY). Ripple (XRP) Price Chart (XRP/JPY). *JPY. + %. 1 Hour 1 Day 1 Week 1 Month 1 Year. Latest news on XRP, a cryptocurrency created by the company Ripple. It is ChatGPT predicts XRP price for September 1, Times Tabloid 9h. XRP. Find the latest XRP CAD (XRP-CAD) stock quote, history, news and other vital information to help you with your stock trading and investing. Find the latest news headlines about Ripple (XRP) at na-sutki-39.ru RLUSD will be valued to the US dollar (USD) and % backed by US dollar deposits, short-term US government treasuries, and other cash equivalents. These. This is way faster than the 2 minutes plus for Ethereum, up to 1 hour or longer for Bitcoin and up to 5 days for traditional systems. The network can also. They Lied About XRP Now THIS Ripple News!. Molt Media. 21K views•6 days ago Ripple XRP price JUMPS 5% in just hours! Cheeky Crypto. K views•4. Super Bullish Ripple (XRP) Price Prediction, but Some Worrying Signs Appear. The cryptocurrency market exploded in the past 24 hours. Almost all of the. Recent news/opinions on the Ripple Network. August 7: In a significant 1 hour ago. Jito Price Prediction Will JTO Price Hit $10? Price / Market Value / Chart >; Ripple (XRP) Price Chart (XRP/JPY). Ripple (XRP) Price Chart (XRP/JPY). *JPY. + %. 1 Hour 1 Day 1 Week 1 Month 1 Year. Latest news on XRP, a cryptocurrency created by the company Ripple. It is ChatGPT predicts XRP price for September 1, Times Tabloid 9h. XRP. Find the latest XRP CAD (XRP-CAD) stock quote, history, news and other vital information to help you with your stock trading and investing. Find the latest news headlines about Ripple (XRP) at na-sutki-39.ru

3 days ago. Ripple News - August 21, SBI CEO Yoshitaka Kitao announces that banks in Japan will begin using Ripple's XRP for transactions by 1 might address the settlement of the Ripple lawsuit. 25 days ago The price of XRP (XRP) is $ today with a hour trading volume. XRP's price today is US$, with a hour trading volume of $ B. Ripple connects financial institutions, payment providers, exchanges, and. Ripple's (XRP) price history reveals an all time high that was not in 1, Jul 8, Aug 14, Sep 20, Oct 27, Dec 3, XRP RIPPLE BIG BREAKING NEWS . CRYPTO with KLAUS. 21K views•1 day ago · SHORTS Ripple XRP price JUMPS 5% in just hours! Cheeky Crypto. K views•4 days. Pro-XRP Lawyer Debunks Ripple-SEC Settlement Rumor For Tomorrow. 1 month ago. To complement the Elliott Wave analysis, Dark Defender employs Fibonacci. At the moment of this writing (August 23, ), Ripple (XRP) price is $, with a 24 hour change of % which decreased from previous day. XRP Price. View live XRP chart to track latest price changes. Trade ideas, forecasts and market news are at your disposal as well. News; Guides; Training · Londinia · Platform · Post an Analysis Request an 1 hour. Central Indicators. Price is back over the pivot point. Type: Bullish. Yahoo Finance Video • 1 hour ago. 1 Dividend Growth ETF That Can Turbocharge Your Portfolio. Motley. Ripple is the catchall name for the cryptocurrency platform, the 1 year. $ $ 5 years. $ $ XRP (xrp) Prices Exchanges. Exchange. Features the Ripple XRP price, the USD price, real-time charts, Ripple XRP news and videos 24 Hour High. $ %. 24 Hour Low. $ Ripple NewsCoinbaseCryptocurrency · Tomiwabold Olajide. Advertisement. Aug 21, - Shiba Inu's Shibarium Turns 1. These Are Its Key. Ripple's XRP Price Prediction , we analyze the future movement of the cryptocurrency. Will 1 hour ago 2 mins read. 4 Hours. 1 Day. 1 Week. Moving Average. On the four-hour chart, XRP is To me, Ripple price forecast #1 is the fairest one coz I am optimistic and. Ripple's (XRP) price history reveals an all time high that was not in 1, Jul 8, Aug 14, Sep 20, Oct 27, Dec 3, 3 days ago. Ripple News - August 21, SBI CEO Yoshitaka Kitao announces that banks in Japan will begin using Ripple's XRP for transactions by 1 day ago · na-sutki-39.ru XRP Jumps 7% as Biggest Breakout in Price History Nears. 1 day ago · Blockchain News, Opinion, Jobs and Video. Here's When Ripple (XRP). Ripple (XRP) is up by % in the past 24 hours, making it the top gainer among the leading XRP Ethereum ETH. r/Ripple - XRP Whales Accumulate Million Coins. Upvote Downvote 1 comments. Share na-sutki-39.ru

Whats An Rrsp

An RRSP, or registered retirement savings plan, is a savings tool that lets you save money over your lifetime while lowering your taxes. If your taxable income when you contribute to your RRSP is higher than when you withdraw, the net result will be a tax savings overall. But if the opposite is. An RRSP is a type of registered investment account, which means you can hold income-generating investments in it versus just cash (like a savings account). The Home Buyers' Plan allows you to withdraw up to $35, from your RRSPs to use as a down payment to buy or build a home. The loan is not considered income. An RRSP is an account designed to help you save for your retirement. It's one of the most popular accounts in Canada. A Registered Retirement Savings Plan (RRSP) is a Canadian investment account designed to help individuals save for retirement on a tax-deferred basis. What is RRSP investing? An RRSP, or a Registered Retirement Savings Plan, is a savings plan that you can contribute to over the course of your working life. The RRSP is a popular retirement savings tool among Canadians and it's an easy way to begin investing in your financial future. A TD RRSP can help you save for retirement, while paying less tax today. Find out how contributing to an RRSP at TD can help you meet your retirement goals. An RRSP, or registered retirement savings plan, is a savings tool that lets you save money over your lifetime while lowering your taxes. If your taxable income when you contribute to your RRSP is higher than when you withdraw, the net result will be a tax savings overall. But if the opposite is. An RRSP is a type of registered investment account, which means you can hold income-generating investments in it versus just cash (like a savings account). The Home Buyers' Plan allows you to withdraw up to $35, from your RRSPs to use as a down payment to buy or build a home. The loan is not considered income. An RRSP is an account designed to help you save for your retirement. It's one of the most popular accounts in Canada. A Registered Retirement Savings Plan (RRSP) is a Canadian investment account designed to help individuals save for retirement on a tax-deferred basis. What is RRSP investing? An RRSP, or a Registered Retirement Savings Plan, is a savings plan that you can contribute to over the course of your working life. The RRSP is a popular retirement savings tool among Canadians and it's an easy way to begin investing in your financial future. A TD RRSP can help you save for retirement, while paying less tax today. Find out how contributing to an RRSP at TD can help you meet your retirement goals.

The Registered Retirement Savings Plan (RRSP) in as a way for Canadians without employer-sponsored pension plans to save money for retirement. A Registered Retirement Savings Plan (RRSP) is a retirement savings plan designed primarily for saving toward your retirement years. Meet your investment goals. Maximize your unused RRSP contribution room. Borrow $5,$50, Not sure if you are saving enough for your retirement? The. An RRSP, or simply, RSP, helps you save for retirement by growing your money and sheltering it from taxes. A Registered Retirement Savings Plan (RRSP) is a savings plan that is registered with the Canada Revenue Agency (CRA). Contributions made to a RRSP are tax-. Registered retirement savings plan (RRSP) contribution limits are based on income of the owner and are tax deductible to the depositor at the time of deposit. A registered retirement savings plan (RRSP) is a Canadian investment vehicle designed for holding savings and investments. Want to talk with us? Speak with an advisor in RRSP and retirement plans to find a tailored solution for you. Save effortlessly with systematic savings. Your. An RRSP (Registered Retirement Savings Plan) is an investment vehicle that lets you save throughout your professional life to compensate for a financial. What is an RRSP? An RRSP is a tax-sheltered investment vehicle that provides you with an effective means of saving for retirement. Contributions to an RRSP. RRSP benefits are strongest when you use the funds as retirement income by converting your RRSP to a Registered Retirement Income Fund (RRIF) or an annuity. You. What is an RRSP? An RRSP is a registered savings plan that lets you save for retirement. You save tax on your contributions, and you don't pay tax on your. A registered retirement savings plan (RRSP) or retirement savings plan (RSP), is a type of financial account in Canada for holding savings and investment. A Registered Retirement Savings Plan (RRSP) is a tax-advantaged retirement savings plan that is established by you and registered by the government. Key Takeaways · An RRSP deduction is the maximum amount that a taxpayer can invest in a retirement account and deduct from that year's income tax. · Generally. A Registered Retirement Savings Plan (RRSP) is a type of investment account available to Canadian residents. It is registered with the Government of Canada. You can contribute funds to an RRSP for yourself, and you can also contribute to an RRSP for your spouse or. A registered retirement savings plan (RRSP) is a special kind of investment account designed to help you save for retirement. It is registered with the. Registered Retirement Savings Plans (RRSPs) are government-registered investment accounts designed to help Canadians save for retirement. You'll lower your lifetime tax rate and can borrow from your Registered Retirement Savings Plan (RRSP) for education or your first home!

Is A Mortgage A Variable Or Fixed Rate

Starting Rate Advantage: Variable rates often start lower than their fixed-rate counterparts, offering initial cost savings that can be attractive for budget-. A fixed term can make the most sense if predictability is important while the risk of early termination is relatively low. For example, if you have no JV. If interest rates are below historic averages, it may make sense to consider a fixed rate. On the other hand, if interest rates are above historic averages, it. A variable mortgage rate is an interest rate which can move up and down at any time, meaning your monthly mortgage payments may occasionally go up or down to. Variable rate mortgages. Variable rate mortgages are mortgages that allow fluctuation on the level of interest that you pay per month. This means that some. Variable rates are typically lower than fixed rates at the time of application. A fixed rate is generally higher to accommodate potential increases due to. When deciding between a fixed or variable rate mortgage, you'll need to decide which one works for your lifestyle and how comfortable you would be if, in the. The other difference to Fixed Rate Mortgages and Variable Rate mortgages is that Fixed-Rate mortgages are often slightly more expensive, i.e. they start at a. Fixed rate: the interest you're charged stays the same for a number of years, typically between 2 and 10 years. · Variable rate: the interest rate you pay can. Starting Rate Advantage: Variable rates often start lower than their fixed-rate counterparts, offering initial cost savings that can be attractive for budget-. A fixed term can make the most sense if predictability is important while the risk of early termination is relatively low. For example, if you have no JV. If interest rates are below historic averages, it may make sense to consider a fixed rate. On the other hand, if interest rates are above historic averages, it. A variable mortgage rate is an interest rate which can move up and down at any time, meaning your monthly mortgage payments may occasionally go up or down to. Variable rate mortgages. Variable rate mortgages are mortgages that allow fluctuation on the level of interest that you pay per month. This means that some. Variable rates are typically lower than fixed rates at the time of application. A fixed rate is generally higher to accommodate potential increases due to. When deciding between a fixed or variable rate mortgage, you'll need to decide which one works for your lifestyle and how comfortable you would be if, in the. The other difference to Fixed Rate Mortgages and Variable Rate mortgages is that Fixed-Rate mortgages are often slightly more expensive, i.e. they start at a. Fixed rate: the interest you're charged stays the same for a number of years, typically between 2 and 10 years. · Variable rate: the interest rate you pay can.

Fixed-rate loan: Your interest rate won't change. It's determined when the loan is taken out, and it remains steady for the life of the loan. · Variable-rate. Your interest rate doesn't change with a fixed-rate mortgage. In contrast, interest rates change with the market for variable-rate mortgages. True to its name, fixed-rate mortgage interest is “fixed” throughout the life of the loan. In contrast, the interest rate on a variable-interest rate loan can. If you're looking for stability and predictability, a fixed-rate mortgage is likely your best choice. But if you feel confident about where the market is going. The difference between a fixed mortgage and a variable mortgage lies between always paying the same installment or one subject to variations. A variable mortgage rate is one that fluctuates with the market interest rate, known as the 'prime rate'. What this means is the amount of your mortgage payment. Fixed-rate mortgages can offer stability, while adjustable-rate mortgages tend to be more flexible. Which would work better for you? Tori L. Preney | April 12, See what you qualify for Get My Rate. Early in the mortgage process, you'll need to decide whether you want a fixed- or. Variable rates are typically lower than fixed rates at the time of application. A fixed rate is generally higher to accommodate potential increases due to. Fixed mortgage interest is higher than variable mortgage interest. The longer your fixed-rate period, the higher your mortgage interest. Fixed means the same and safe, while variable means change and risky. If you are planning to stay in your home a long time, you would rarely consider a loan. Variable Rate Mortgage. With a variable rate mortgage, mortgage payments are set for the term, even though interest rates may fluctuate during that time. If. The other difference to Fixed Rate Mortgages and Variable Rate mortgages is that Fixed-Rate mortgages are often slightly more expensive, i.e. they start at a. Throughout , mortgage rates steadily ticked upward, pricing many prospective homebuyers out of the market. The interest rate on a year fixed-rate. A variable mortgage rate is an interest rate which can move up and down at any time, meaning your monthly mortgage payments may occasionally go up or down to. When setting fixed rates the banks are in general Trying to gauge the future market to ensure that irrespective of the actual rate they always. They generally have lower starting interest rates than fixed rate loans, but the interest rate and payment amounts can change over time. Sometimes they are also. Your interest rate doesn't change with a fixed-rate mortgage. In contrast, interest rates change with the market for variable-rate mortgages. When setting fixed rates the banks are in general Trying to gauge the future market to ensure that irrespective of the actual rate they always. Adjustable-rate mortgages (ARMs), also known as variable-rate mortgages, have an interest rate that may change periodically depending on changes in a.

Strpf Stock Price

Starr Peak Mining Ltd. historical stock charts and prices, analyst ratings, financials, and today's real-time STRPF stock price. STRPF Stock, USD %. As of 8th of August , the value of RSI The successful prediction of Starr Peak stock price could yield a significant. Starr Peak Mining Ltd STRPF:OTCQX · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date09/08/23 · 52 Week Low. STRPF Starr Peak Mining Ltd. Stock Price & Overview ; Earnings Revisions. FY1 Up Revisions. FY1 Down Revisions ; Valuation. P/E Non-GAAP (FWD) · P/E GAAP (TTM). NM. Starr Peak Mining (QX) (STRPF) - Trades. Free real-time prices and the UK's most active stock market forums. STRPF: Starr Peak Mining Ltd ; CLOSING STRPF STOCK PRICE $ 52 WEEK HIGH STOCK PRICE $ 52 WEEK LOW STOCK PRICE ; REVENUE $0. NET INCOME $, CASH. Starr Peak Mining Ltd stocks price quote with latest real-time prices Starr Peak Mining Ltd (STRPF). Starr Peak Mining Ltd (STRPF). Starr Peak Mining Ltd (QX) is listed in the sector of the OTCMarkets with ticker STRPF. The last closing price for Starr Peak Mining (QX) was $ Discover real-time Starr Peak Mining Ltd (STRPF) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Starr Peak Mining Ltd. historical stock charts and prices, analyst ratings, financials, and today's real-time STRPF stock price. STRPF Stock, USD %. As of 8th of August , the value of RSI The successful prediction of Starr Peak stock price could yield a significant. Starr Peak Mining Ltd STRPF:OTCQX · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date09/08/23 · 52 Week Low. STRPF Starr Peak Mining Ltd. Stock Price & Overview ; Earnings Revisions. FY1 Up Revisions. FY1 Down Revisions ; Valuation. P/E Non-GAAP (FWD) · P/E GAAP (TTM). NM. Starr Peak Mining (QX) (STRPF) - Trades. Free real-time prices and the UK's most active stock market forums. STRPF: Starr Peak Mining Ltd ; CLOSING STRPF STOCK PRICE $ 52 WEEK HIGH STOCK PRICE $ 52 WEEK LOW STOCK PRICE ; REVENUE $0. NET INCOME $, CASH. Starr Peak Mining Ltd stocks price quote with latest real-time prices Starr Peak Mining Ltd (STRPF). Starr Peak Mining Ltd (STRPF). Starr Peak Mining Ltd (QX) is listed in the sector of the OTCMarkets with ticker STRPF. The last closing price for Starr Peak Mining (QX) was $ Discover real-time Starr Peak Mining Ltd (STRPF) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions.

Starr Peak Mining Ltd. analyst ratings, historical stock prices, earnings estimates & actuals. STRPF updated stock price target summary. Starr Peak Mining Ltd. (STRPF) chart price and fundamental data. Compare data across different stocks & funds. Get Starr Peak Mining Ltd (STE.V) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. View the STE premarket stock price ahead of the market session or assess the after hours quote. Monitor the latest movements within the Starr Peak Exploration. Find the latest Starr Peak Mining Ltd. (STE.V) stock quote, history, news and other vital information to help you with your stock trading and investing. Find the latest Starr Peak Exploration Ltd (STRPF) stock forecast, month price target, predictions and analyst recommendations. Check if STRPF Stock has a Buy or Sell Evaluation. STRPF Stock Price (OTCBB), Forecast, Predictions, Stock Analysis and Starr Peak Exploration Ltd. News. Starr Peak Mining Ltd. advanced stock charts by MarketWatch. View STRPF historial stock data and compare to other stocks and exchanges Set a price target. STRPF Stock price | View the latest Starr Peak Mining Ltd. stock price, news, financial information and reports by Fundamental Research Corp. Stock analysis for Starr Peak Mining Ltd (STRPF:OTC US) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Starr Peak Mining Ltd. (STRPF) has a market cap of $ and a live price of $ Check more stats and compare it to other stocks and crypto. Starr Peak Mining Ltd. (STRPF.): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Starr Peak Mining Ltd. | OTC Markets. Here are STRPF's fundamentals. Value. Is this stock cheap or expensive? Forward P/E. Show. Enterprise Value to Sales. Show. Free Cash Flow Yield. Show. STRPF Price is USD today. 1 year Starr Peak Exploration Forecast: *. 5 year Starr Peak Exploration Forecast: *. btn. About the Starr. Stock analysis for Starr Peak Mining Ltd (STRPF:OTC US) including stock price, stock chart, company news, key statistics, fundamentals and company profile. STRPF) is pleased to announce that Mr. John Fahmy has been appointed to the Board of Directors of the Company. Mr. Fahmy is an investor/consultant to. US Stock MarketDetailed Quotes. STRPF STARR PEAK MINING LTD. 15min Delay Close Aug 22 ET. %. Market CapM. P/E (TTM) Starr Peak Mining Stock (OTC: STRPF) stock price, news, charts, stock research, profile. Starr Peak Mining Ltd (STRPF) ; 5-Day, , +, +%, 9, ; Day, , +, +%, 5,

Cash Out Refi Investment Property Rates

General cash-out refinance requirements · Equity: At least % equity in your home · Credit score: , though many lenders have higher credit score. Types of Investment Property Refinancing. There are two main types of refinance investment property loans: rate and term refinance and cash out refinance. Higher interest rates: Cash-out refinances on rental units typically come with interest rates that are about 1% higher than a no-cash mortgage refinances on a. Cash-out refinance mortgage options can help borrowers leverage home equity for immediate cash flow. Whether borrowers want to consolidate debt or obtain. A cash-out refinance replaces an existing mortgage with a new loan with a higher balance, sometimes with more favorable terms than the current loan. Cash-out refinance loans are the fast and easy option for real estate investors looking to take equity from an existing investment property to reinvest the. “The interest rate for rental cash-out refinancing is usually about 1% higher than the interest rate for cashless mortgage refinancing,” Nabity said. My question to the community is it worth doing a cash-out refinance for $k and losing that interest rate or possibly getting a HELOC on the rental property. Cash-out refinance on a rental property turns accrued equity into cash for reinvestment. Rental property refinance loans may have slightly higher interest rates. General cash-out refinance requirements · Equity: At least % equity in your home · Credit score: , though many lenders have higher credit score. Types of Investment Property Refinancing. There are two main types of refinance investment property loans: rate and term refinance and cash out refinance. Higher interest rates: Cash-out refinances on rental units typically come with interest rates that are about 1% higher than a no-cash mortgage refinances on a. Cash-out refinance mortgage options can help borrowers leverage home equity for immediate cash flow. Whether borrowers want to consolidate debt or obtain. A cash-out refinance replaces an existing mortgage with a new loan with a higher balance, sometimes with more favorable terms than the current loan. Cash-out refinance loans are the fast and easy option for real estate investors looking to take equity from an existing investment property to reinvest the. “The interest rate for rental cash-out refinancing is usually about 1% higher than the interest rate for cashless mortgage refinancing,” Nabity said. My question to the community is it worth doing a cash-out refinance for $k and losing that interest rate or possibly getting a HELOC on the rental property. Cash-out refinance on a rental property turns accrued equity into cash for reinvestment. Rental property refinance loans may have slightly higher interest rates.

View today's cash-out refinance rates in your area and get a personalized quote in minutes.

Today's competitive refinance rates ; Rate · % · % · % ; APR · % · % · % ; Points · · · 70% on a unit investment property. The Max Debt to Income (DTI) for our Cash-Out Refi loans will be determined through Desktop Underwriter Engine. Delayed. Refi Loan Parameters for the Best Cash Out Refinance for Investment Property · 1 to rental properties · No Personal Income/debt ratios are used · Consolidate. A cash-out refinance lets you refinance your investment property's current mortgage, borrow more than you currently owe and keep the difference (home equity). Start the process by looking at investment property refinance rates to be sure they represent a savings over your current rates. Use that extra cash to: · Lower interest rates than a personal loan or credit card · No additional monthly payments · Longer repayment terms · No prepayment. 50 votes, comments. Hey! Sorry this is a newb question. I don't understand why someone would take equity out of one rental property. On September 5, , the national average year fixed refinance rate decreased 11 basis points to %. The current average year fixed refinance rate. For example, Ian has a primary residence single-family home with a property value of $, and a current mortgage balance of $, His calculations would. National mortgage rates by loan type ; % · % · % · % ; % · % · % · %. The interest rates for cash out refinances secured by investment and rental houses can often be higher than for primary residences. That's because lenders can. With a cash out refinance, you replace your current mortgage with a new mortgage for a higher amount and get the difference in cash at closing. For example, if. Current Investment Property Mortgage Rates ; Sammamish Mortgage Company. NMLS # · % · $1, /mo · % ; New American Funding, LLC. NMLS # · %. Get a Lower Interest Rate – Refinancing your current mortgage can lower your interest rate to give you lower monthly payments. Money to Invest – You plan to use. Keeping the maximum 80% LTV ratio requirement in mind, you may borrow up to an additional $60, with a cash-out refinance. To calculate this, multiply your. Cash Out Refinance Rates · Loan Amount: Up to 75% LTV · Interest Rate: Look for rates in the range of 5% — 6% if you have excellent credit. · Lender Fees: 0% — 3%. Using a cash-out refinance to consolidate debt increases your mortgage debt, reduces equity, and extends the term on shorter-term debt and secures such debts. The 2% Rule In Florida For Cash-Out Refinance If you're in the process of looking for a loan for property investment in Florida, the 2 % rule is something to. In other words, if the equivalent consumer mortgage rate is %, the rate for a single-family investment property will be % to %. leads. Investment.

1 2 3 4 5 6