na-sutki-39.ru

Market

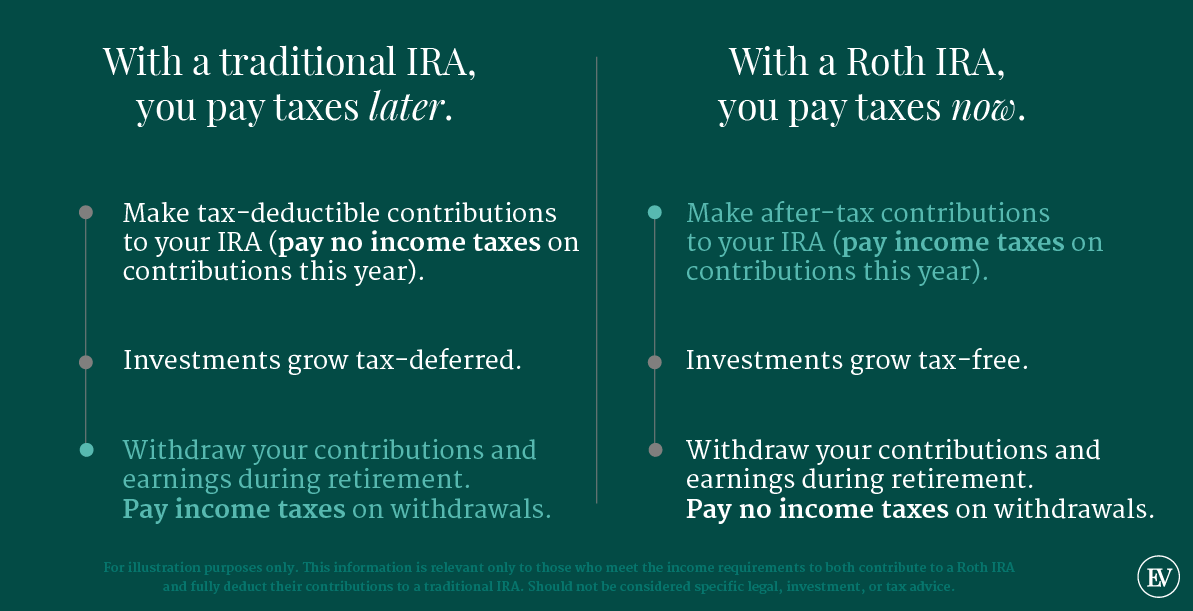

Roll Ira Into Roth Ira

Generally, a Roth IRA conversion makes sense if you: · Won't need the converted Roth funds for at least five years. · Expect to be in the same or a higher tax. A Roth IRA conversion is the process of rolling over all (or a portion) of your balances from either an existing traditional IRA, SEP, or SIMPLE IRA into a. You have 60 days from the date you receive an IRA or retirement plan distribution to roll it over to another plan or IRA. The IRS may waive the day rollover. A rollover IRA is not a different IRA. It's a Traditional IRA or Roth IRA that you are using to consolidate your retirement accounts. Most plans qualify. Same trustee transfer: When your IRAs are held at the same financial institution, you can tell the trustee to transfer an amount from your traditional IRA to. A Roth IRA rollover is very simple to complete. Common practice is to simply contact the administrator for your current retirement account and request a. When you make a transfer from a rollover IRA to a Roth IRA this is called a Roth conversion. A Roth conversion occurs when an account owner. In a direct rollover, your financial institution or retirement plan administrator directly sends funds to a TIAA IRA. In an indirect IRA rollover, the financial. How do I convert my traditional IRA to a Roth IRA? · Rollover – You receive a distribution from a traditional IRA and contribute it to a Roth IRA within 60 days. Generally, a Roth IRA conversion makes sense if you: · Won't need the converted Roth funds for at least five years. · Expect to be in the same or a higher tax. A Roth IRA conversion is the process of rolling over all (or a portion) of your balances from either an existing traditional IRA, SEP, or SIMPLE IRA into a. You have 60 days from the date you receive an IRA or retirement plan distribution to roll it over to another plan or IRA. The IRS may waive the day rollover. A rollover IRA is not a different IRA. It's a Traditional IRA or Roth IRA that you are using to consolidate your retirement accounts. Most plans qualify. Same trustee transfer: When your IRAs are held at the same financial institution, you can tell the trustee to transfer an amount from your traditional IRA to. A Roth IRA rollover is very simple to complete. Common practice is to simply contact the administrator for your current retirement account and request a. When you make a transfer from a rollover IRA to a Roth IRA this is called a Roth conversion. A Roth conversion occurs when an account owner. In a direct rollover, your financial institution or retirement plan administrator directly sends funds to a TIAA IRA. In an indirect IRA rollover, the financial. How do I convert my traditional IRA to a Roth IRA? · Rollover – You receive a distribution from a traditional IRA and contribute it to a Roth IRA within 60 days.

distribution or include them in the conversion rollover to the Roth IRA and pay taxes on the earnings portion. • For non-Fidelity IRAs, a check made payable to. Transfer the assets by completing a mutual fund IRA Transfer Form or Brokerage IRA Transfer Form. Complete this IRA Roth Conversion Form. Use this form to convert all or a portion of an existing “traditional” Merrill Individual Retirement Account (IRA), Rollover IRA (IRRA®), SEP or SIMPLE. If you don't agree with the taxable amount calculating on Form , line 4b, refer to Form , Page 2, line The amount from line 18 will transfer to. A Roth IRA conversion involves moving assets from other retirement plans into your Roth IRA. Learn how to convert a Roth IRA and whether it's right for you. All tax-deferred IRAs, including traditional, rollover, SIMPLE,2. SEP, and SAR-SEP IRAs, are eligible for a Roth IRA conversion. Tax legislation enacted in. Generally, a rollover is a tax-free distribution to you from a previous retirement plan or IRA that you transfer to another retirement plan or IRA. A rollover. There's no age limit or income requirement to be able to convert a traditional IRA to a Roth. You must pay taxes on the amount converted. Use this form to convert all or a portion of an existing “traditional” Merrill Individual Retirement Account (IRA), Rollover IRA (IRRA®), SEP or SIMPLE. Generally, a rollover is a tax-free distribution to you from a previous retirement plan or IRA that you transfer to another retirement plan or IRA. A rollover. In a Roth IRA conversion, you can roll funds from a pretax retirement account, like a traditional IRA, into a Roth, thus avoiding income taxes on the. Converting to a Roth IRA When converting your before-tax savings, you're including the converted amount as ordinary income, but without an IRS 10% additional. For instance, if you expect your income level to be lower in a particular year but increase again in later years, you can initiate a Roth conversion to. Pre-tax assets that are converted from a traditional IRA or other eligible retirement plan to a Roth IRA are treated as a taxable distribution and are subject. The original conversion from a Traditional IRA to a Roth IRA must be completed within 60 days after the end of the tax year. A distribution from an IRA is. A rollover IRA is a retirement account that allows you to move money from your former employer-sponsored plan to an IRA—tax and penalty-free. IRA Transfer · You can transfer a Traditional IRA at one institution to a new or existing Traditional IRA held by a different provider. · A Roth IRA can only be. Roth IRA conversions involve transferring assets from a traditional pre-tax retirement account to a Roth IRA. This could be from a (k) or (b), for. Yes, it could make sense to open a Roth IRA at least five years before you plan to rollover your Roth (k). However, it's not enough to open it. How do you transfer funds to a Roth IRA? You can convert the funds by having your plan administrator facilitate the funds transfer, or by allowing the.

What Is The Best Hedge Against Inflation

The stock market is a wonderful hedge against inflation for a few reasons. Since , the U.S. stock market is up % per year while inflation has averaged 3%. Simply put, an inflation hedge is an investment designed to protect your portfolio against a decrease in our currency's purchasing power, no matter where your. Traditionally, investments such as gold and real estate are preferred as a good hedge against inflation. However, some investors still prefer investing in. Self Storage Real Estate is a Great Inflation Hedge. While stocks, bonds, and cash lose their purchasing power as inflation rises, investing in self-storage. Gold is a proven long-term hedge against inflation but its performance in the short term is less convincing. Investments in gold and other precious metals have been a traditional method to hedge against inflation and times of economic distort. The value of gold and. There are several assets that have been an hedge against inflation, but over long periods of time. Some examples include: Gold, stocks, commodies, real estate. The most direct way to hedge against inflation it is to buy U.S. Treasury Inflation Protected Securities (TIPS), which will increase in value at. When limited only to financial assets, the energy equity sector provides the best potential inflation hedge, with positive inflation-adjusted return potential. The stock market is a wonderful hedge against inflation for a few reasons. Since , the U.S. stock market is up % per year while inflation has averaged 3%. Simply put, an inflation hedge is an investment designed to protect your portfolio against a decrease in our currency's purchasing power, no matter where your. Traditionally, investments such as gold and real estate are preferred as a good hedge against inflation. However, some investors still prefer investing in. Self Storage Real Estate is a Great Inflation Hedge. While stocks, bonds, and cash lose their purchasing power as inflation rises, investing in self-storage. Gold is a proven long-term hedge against inflation but its performance in the short term is less convincing. Investments in gold and other precious metals have been a traditional method to hedge against inflation and times of economic distort. The value of gold and. There are several assets that have been an hedge against inflation, but over long periods of time. Some examples include: Gold, stocks, commodies, real estate. The most direct way to hedge against inflation it is to buy U.S. Treasury Inflation Protected Securities (TIPS), which will increase in value at. When limited only to financial assets, the energy equity sector provides the best potential inflation hedge, with positive inflation-adjusted return potential.

There are six potential hedges against inflation: real estate, TIPS, commodities, stocks, gold, and bitcoin. Some work best for good inflation. Real estate is also a good hedge against inflation. and sometimes real estate inflation can even work to your advantage. Imagine there is a money supply of. Gold is the traditional inflationary hedge. Metal coin debasements resulted in inflation in Egypt from to BC and in China from to During these. This makes real estate one of the best hedges against inflation. This price appreciation means that exposure to the commodity market can be a good hedge. “TIPS are by far the best inflation hedge for the average investor,” she tells Select. TIPS bonds pay interest twice a year at a fixed rate, and they are. Many investors believe gold can be an excellent hedge against inflation, as it holds its value while currencies decrease in value. Hard assets can act as a hedge against inflation, helping you navigate through an uncertain economic landscape highest inflation rate since We saw a. Real estate is a well-known hedge against inflation. As the price of raw materials and labor goes up, new properties are more expensive to build. Which assets should I consider as inflation hedges? · Treasury inflation-protected securities (TIPS) · Series I savings bonds · Floating rate bonds · Commodities. When viewed through these lenses, farmland is arguably the absolute best hedge against inflation. In addition, farmland earns an annual income, which gold. According to historical data, stocks of companies that can raise prices for their products are actually the best hedges against inflation. They. Discover 12 inflation-resistant investments in , including fine wine, gold, and commodities. We'll also explore how Vinovest can help you hedge against. Many investors believe gold can be an excellent hedge against inflation, as it holds its value while currencies decrease in value. The top-performing asset class during the period was crude oil, but it would be a mistake to buy crude oil as an inflation hedge today. In the s, a. 2. Precious Metal Precious metals like gold and silver have high economic value and act as a great hedge against rising inflation. Gold has been readily used. The best hedge against inflation are income producing assets. Things like real estate or dividend stocks which provide consistent cash flow. Inflation Hedge - protect your retirement savings from high inflation by hedging your money against it with gold and silver, and other. Commercial real estate is a well-known inflationary hedge. During periods of inflation, investors turn to real property because it's a tangible asset with. The claim that real estate is a good hedge against inflation appears reasonable on theoretical grounds. All other things being equal, during periods of. Together with gold, other precious metals such as silver and platinum are also considered by some as good inflation hedge assets. Trade Gold CFDs with Admirals.

Sofi Student Loan Refinance Reviews

SoFi's federal student loan refinancing allows borrowers to consolidate eligible federal loans into a new private student loan with potentially lower rates. I refinanced the same loan with them again to get a lower rate and now I am at % for 7 years which shaves off another $3, My credit scores wasn't any. SoFi student loan refinancing may be a good option for health professionals and borrowers with excellent credit. SoFi offers debt relief and competitive low. SoFi is an online student loan refinancing company, with over , members who have refinanced over $30 billion in student loans. SoFi offers approval within. SoFi was one of the first companies to focus exclusively on student loan refinancing but has now expanded to include other products. Borrowers can refinance. SoFi is an online student loan refinancing company, with over , members who have refinanced over $30 billion in student loans. SoFi offers approval. Today, more than , borrowers have refinanced $18 billion in student loans with SoFi. It's no wonder considering the company offers no fees, competitive. SoFi Student Loan Refinancing is STRONGLY RECOMMENDED based on 53 reviews. Find out what other users have to say about its key features. If you're interested in refinancing student loans for better rates, SoFi offers refinancing options with no application or origination fees. As with its private. SoFi's federal student loan refinancing allows borrowers to consolidate eligible federal loans into a new private student loan with potentially lower rates. I refinanced the same loan with them again to get a lower rate and now I am at % for 7 years which shaves off another $3, My credit scores wasn't any. SoFi student loan refinancing may be a good option for health professionals and borrowers with excellent credit. SoFi offers debt relief and competitive low. SoFi is an online student loan refinancing company, with over , members who have refinanced over $30 billion in student loans. SoFi offers approval within. SoFi was one of the first companies to focus exclusively on student loan refinancing but has now expanded to include other products. Borrowers can refinance. SoFi is an online student loan refinancing company, with over , members who have refinanced over $30 billion in student loans. SoFi offers approval. Today, more than , borrowers have refinanced $18 billion in student loans with SoFi. It's no wonder considering the company offers no fees, competitive. SoFi Student Loan Refinancing is STRONGLY RECOMMENDED based on 53 reviews. Find out what other users have to say about its key features. If you're interested in refinancing student loans for better rates, SoFi offers refinancing options with no application or origination fees. As with its private.

SoFi Student Loan Refinancing SoFi began as a student loan refinancing company before it started originating private student loans. The interest rates for. SoFi members bring their ambitions to life with help from products like: Student Loan Refinancing · Personal Loans · Mortgage Loans · Private Student Loans. † To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. However, if you choose a product. Products & Services. This company offers student loan refinancing, mortgages and personal loans. Business Details. This is a multi-location business. SoFi Student Loan Refinancing is a great option for borrowers looking to refinance at a lower rate while also having some protections should something in their. SoFi doesn't offer a co-signer release or the lowest student loan refinance rates. However, existing SoFi customers could get a % interest rate discount on. Variable interest rates as low as percent APR, while fixed rates start at percent, with repayment options between five and 20 years. Read Bankrate's. Variable rates range from % APR to % APR with a % autopay discount. Unless required to be lower to comply with applicable law, Variable Interest. SoFi is an industry-leading lender for doctors. Our lowest rates start at just % APR* View Disclaimer - Our lowest rates start at just % APR (with all. SoFi - Provided Excellent Service, From Start to Finish, the whole process was Flawless, Great communication! Professional Staff! Very Attentive to Detail and. Competitive interest rates. SoFi offers fixed rates starting at %* and variable rates starting at %*. · High loan amounts. You can refinance a minimum of. Sofi leads with the customer experience and customer service first. Following the loan process milestones was a cinch and their automated emails. Yes, SoFi is a legitimate company because it has an A+ rating from the Better Business Bureau. Also, SoFi personal loans have a rating of /5 from WalletHub's. SoFi has an A+ rating with the Better Business Bureau and a star out of 5 rating on Trustpilot, which is considered excellent based on more than 8, Refinancing Student Loans: SoFi presents refinancing options for student loans with competitive fixed rates starting at %, and without any associated fees. Credible and SoFi are both highly ranked student loan refinancing companies, offering lower interest rates and shorter loan terms. OVERALL RATINGS ; Loan Specifications, /5, /5 ; Eligibility Requirements, /5, /5 ; Customer Experience, /5, /5 ; Reputation, /5, /5. Choose your mortgage refinance rate. · year fixed · % Rate · % APR · year fixed · % Rate · % APR · year fixed · % Rate. Yes, you can refinance your SoFi student loan. SoFi offers refinancing options for both federal and private student loans, allowing approved borrowers to secure. SoFi is a leading student loan refinancing provider having helped over , borrowers refinance over $18 billion in student loans of the $ trillion.

Usd Fx Rate Gbp

50 USD, GBP ; USD, GBP ; USD, GBP ; USD, GBP. Popular CurrenciesCollapse ; EUROZONE, EURO (EUR) 1 EUR = USD ; GREAT BRITAIN, POUND (GBP) 1 GBP = USD ; HONG KONG, DOLLAR (HKD) 1 HKD = USD. Our currency rankings show that the most popular British Pound exchange rate is the GBP to USD rate. The currency code for British Pounds is GBP. Pound Dollar Exchange Rate (GBP USD) - Historical Chart ; , , , , Graph and download economic data for U.S. Dollars to U.K. Pound Sterling Spot Exchange Rate (DEXUSUK) from to about United Kingdom. Pound Dollar Exchange Rate (GBP USD) - Historical Chart ; , , , , The latest on GBP to USD exchange rates. One British pound currently exchanges at a rate of USD. To see the latest exchange rate and compare historic. A foreign exchange term used to describe the British pound vs the US dollar, is one of the oldest traded currency pairs. 1 USD To GBP Convert United States Dollar To British Pound Sterling. 1 USD = GBP Aug 26, UTC. 50 USD, GBP ; USD, GBP ; USD, GBP ; USD, GBP. Popular CurrenciesCollapse ; EUROZONE, EURO (EUR) 1 EUR = USD ; GREAT BRITAIN, POUND (GBP) 1 GBP = USD ; HONG KONG, DOLLAR (HKD) 1 HKD = USD. Our currency rankings show that the most popular British Pound exchange rate is the GBP to USD rate. The currency code for British Pounds is GBP. Pound Dollar Exchange Rate (GBP USD) - Historical Chart ; , , , , Graph and download economic data for U.S. Dollars to U.K. Pound Sterling Spot Exchange Rate (DEXUSUK) from to about United Kingdom. Pound Dollar Exchange Rate (GBP USD) - Historical Chart ; , , , , The latest on GBP to USD exchange rates. One British pound currently exchanges at a rate of USD. To see the latest exchange rate and compare historic. A foreign exchange term used to describe the British pound vs the US dollar, is one of the oldest traded currency pairs. 1 USD To GBP Convert United States Dollar To British Pound Sterling. 1 USD = GBP Aug 26, UTC.

Chinese Yuan Renminbi · EUR Euro · GBP Great British Pound · HKD Hong Kong Dollar USD US Dollar · ZAR South African Rand. What is OANDA's Currency Converter. NY Closing Exchange Rates · Key Cross Rates. to. Download a Spreadsheet. DATE, OPEN, HIGH, LOW, CLOSE. 08/23/24, , , , 08/22/ GBP/USD exchange rate. Charts, forecast poll, current trading positions and technical analysis. Keep informed on GBP/USD updates. Pounds to Dollars Currency Converter ; FOREX DATA ; GBP/USD, +0 ; , △, +0%. Current exchange rate US DOLLAR (USD) to BRITISH POUND (GBP) including currency converter, buying & selling rate and historical conversion chart. Get live data on the GBP/USD rate with the interactive chart. Read the latest news, analysis and EUR/USD forecasts brought to you by the DailyFX team. US dollar (USD). ECB euro reference exchange rate. 26 August EUR 1 = USD (%). Change from 28 August to 26 August Min (3 October. The Yahoo Finance guide to the US presidential race. CCY - Delayed Quote • USD. GBP/USD (GBPUSD=X). Follow. (%). As of AM GMT+1. British Pounds to US Dollars conversion rates ; 1 USD, GBP ; 5 USD, GBP ; 10 USD, GBP ; 25 USD, GBP. GBP to USD exchange rate live currency chart. Convert pounds to US dollars and enjoy competitive exchange rates and low transfer fees with moneycorp. US dollars to British pounds sterling today. Convert USD to GBP at the real exchange rate. Amount. 1, usd. Converted to. gbp. $ USD = £ GBP. Live GBP/USD Exchange Rate Data, Calculator, Chart, Statistics, Volumes and History ; Today's Open: ; Today's High: ; Today's Low: US Dollars to British Pounds conversion rates ; 1 GBP, USD ; 5 GBP, USD ; 10 GBP, USD ; 25 GBP, USD. Post Office® Travel Money Sale – even better US dollar rates all summer long. Order dollars online by 2pm Mon-Fri & collect in branch or get next day. British Pounds to US Dollars conversion rates ; 1 USD, GBP ; 5 USD, GBP ; 10 USD, GBP ; 25 USD, GBP. US dollar to British pounds sterling exchange rate history. The exchange rate for US dollar to British pounds sterling is currently today, reflecting a. Get the latest Pound sterling to United States Dollar (GBP / USD) real-time quote, historical performance, charts, and other financial information to help. GBP/USD - British Pound US Dollar ; +(+%). Real-time Data ; Day's Range. 52 wk Range. US Dollar- British Pound · Price (GBP) · Today's Change / % · 1 Year change% · 52 week range - Get the latest Pound sterling to United States Dollar (GBP / USD) real-time quote, historical performance, charts, and other financial information to help.

Teeter Back Inversion Table

FitSpine® Accessories – Add deeper traction with the Lumbar Bridge to release the lower back or use the Acupressure Nodes to relief muscle tension with targeted. Innovative Design: Engineers specifically designed the EP to follow the natural curves of the back for a more comfortable and effective inversion experience. FDA REGISTERED (k) DEVICE: Teeter is the ONLY FDA registered inversion table. Indicated for back pain, muscle tension, herniated disc, sciatica. The Teeter is indicated for back pain, muscle tension and spasm, herniated disc, sciatica, degenerative disc disease, spinal stenosis, spinal curvature due to. back. Neck Support Use with the cushion or on its own to place the neck in a gentle arch, helping to restore curvature and provide an additional stretch to. This inversion table is built with superior components including pressure-reducing, specialty-foam ankle supports, a patented track-style bed and heat-treated. Inversion tables at Relax The Back offer natural spinal decompression that can help reduce back pain, relieve pressure from your joints and ease muscle. Decompression Arch can be positioned behind the neck or back for deeper compression and improved alignment; Large Support Hand Grips are rubber-coated and. Lightweight and easy-to-use. Decompress the lower back, relax tense muscles, reduce nerve pressure and pain. Portable travel solution. FitSpine® Accessories – Add deeper traction with the Lumbar Bridge to release the lower back or use the Acupressure Nodes to relief muscle tension with targeted. Innovative Design: Engineers specifically designed the EP to follow the natural curves of the back for a more comfortable and effective inversion experience. FDA REGISTERED (k) DEVICE: Teeter is the ONLY FDA registered inversion table. Indicated for back pain, muscle tension, herniated disc, sciatica. The Teeter is indicated for back pain, muscle tension and spasm, herniated disc, sciatica, degenerative disc disease, spinal stenosis, spinal curvature due to. back. Neck Support Use with the cushion or on its own to place the neck in a gentle arch, helping to restore curvature and provide an additional stretch to. This inversion table is built with superior components including pressure-reducing, specialty-foam ankle supports, a patented track-style bed and heat-treated. Inversion tables at Relax The Back offer natural spinal decompression that can help reduce back pain, relieve pressure from your joints and ease muscle. Decompression Arch can be positioned behind the neck or back for deeper compression and improved alignment; Large Support Hand Grips are rubber-coated and. Lightweight and easy-to-use. Decompress the lower back, relax tense muscles, reduce nerve pressure and pain. Portable travel solution.

Relieve back pain and improve the health of your spine and joints with great offers on inversion tables at na-sutki-39.ru! Tbh I bought one a few weeks ago but I'm too scared to try it. My husband did try it (just regular getting older back pain) and said it did. Using an inversion table like the EP can also help to give the back a greater flexibility and relaxation. Teeter Hang Ups has been making inversion tables. Hang ups Teeter INVERSION TABLE INJURIES: COMPLETE OR PARTIAL PARALYSIS. It is unclear if inversion tables actually relieve neck and low back pain. What is. TEETER EP LTD. Inversion Table w/Heat & Vibration Comfort Cushion for Back Pain, FDA-Registered, UL Safety-Certified, lb Capacity. Shop for Health Gear Body Vision XL Acupressure Massage Inversion Table for Back Pain (1 Piece) at Harris Teeter. Find quality health products to add to. This inversion table is built with superior components including pressure-reducing, specialty-foam ankle supports, a patented track-style bed and heat-treated. Ideal for back pain sufferers, the EZ-Reach Ankle System with extended handle reduces bending when securing the ankle supports. EZ-Stretch Traction Handles add. MULTI-PUPOSE. This heavy duty stamina inversion table can help relieve the stress that is built up around your neck and back, strengthen the muscles of the. Teeter FitSpine X1 Inversion Table Back Stretch Table. Teeter FitSpine Inversion Table X1. Price. Your Price: $ Availability: In Stock. Part Number. Discover the Teeter FitSpine® X1 Inversion Table, a natural back pain solution that has helped over 3 million people live more and ache less. The only. Relieve back pain today with Teeter Hang Ups Inversion Tables. Lowest Price guaranteed backed by BuySafe! Shop Teeter Hang Ups and inversion therapy today. You simply hang upside down on a Teeter Inversion table for a few minutes each day. Benefits of owning an inversion table. Owning your own inversion table. The Teeter FitSpine X2 Inversion Table helps relieve sore back pain for more comfort. Check out this FitSpine inversion table for back relief today! Inversion Table (to receive the maximum benefits from your inversion table). EZ Stretch Traction Handles: With the muscles in your lower back relaxed. Teeter's ComforTrak Series Inversion Tables enhance the user experience to achieve the ultimate in joint and back pain relief through precision balancing. The Teeter FitSpine X2 Inversion Table helps relieve sore back pain for more comfort. Check out this FitSpine inversion table for back relief today! Inversion Table (to receive the maximum benefits from your inversion table). EZ Stretch Traction Handles: With the muscles in your lower back relaxed. Prioritize your health and well being with shopping the latest Teeter Hang Ups inversion tables at HSN. Hang ups Teeter INVERSION TABLE INJURIES: COMPLETE OR PARTIAL PARALYSIS. It is unclear if inversion tables actually relieve neck and low back pain. What is.

Ishares Core S&P 500 Etf Stock

IVV - one of several ETFs that track the S&P Index-delivers excellent large-cap exposure. Despite the common perception that the S&P provides pure. View the latest iShares Core S&P ETF (IVV) stock price and news, and other vital information for better exchange traded fund investing. The iShares Core S&P ETF seeks to track the investment results of an index composed of large-capitalization U.S. equities. The S&P ® index tracks the largest US stocks. The ETF's TER (total expense ratio) amounts to % p.a.. The ETF replicates the performance of the. IVV Performance - Review the performance history of the iShares Core S&P ETF to see it's current status, yearly returns, and dividend history. Yes, you can purchase fractional shares of iShares Core S&P ETF (IVV) on Vested. You can start investing in iShares Core S&P ETF (IVV) with a minimum. The Fund seeks to track the performance of an index composed of large cap U.S. companies. View the latest iShares Core S&P ETF (IVV) stock price and news, and other vital information for better exchange traded fund investing. View Top Holdings and Key Holding Information for iShares Core S&P ETF (IVV) VIOO Vanguard S&P Small-Cap Index Fund ETF Shares. +%. XMVM. IVV - one of several ETFs that track the S&P Index-delivers excellent large-cap exposure. Despite the common perception that the S&P provides pure. View the latest iShares Core S&P ETF (IVV) stock price and news, and other vital information for better exchange traded fund investing. The iShares Core S&P ETF seeks to track the investment results of an index composed of large-capitalization U.S. equities. The S&P ® index tracks the largest US stocks. The ETF's TER (total expense ratio) amounts to % p.a.. The ETF replicates the performance of the. IVV Performance - Review the performance history of the iShares Core S&P ETF to see it's current status, yearly returns, and dividend history. Yes, you can purchase fractional shares of iShares Core S&P ETF (IVV) on Vested. You can start investing in iShares Core S&P ETF (IVV) with a minimum. The Fund seeks to track the performance of an index composed of large cap U.S. companies. View the latest iShares Core S&P ETF (IVV) stock price and news, and other vital information for better exchange traded fund investing. View Top Holdings and Key Holding Information for iShares Core S&P ETF (IVV) VIOO Vanguard S&P Small-Cap Index Fund ETF Shares. +%. XMVM.

Vanguard S&P ETF. $ VOO ; Invesco QQQ Trust, Series 1. $ QQQ ; SPDR S&P ETF Trust. $ SPY ; SPDR Portfolio S&P ETF. $ SPLG. View iShares Core S&P ETF (IVV) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. iShares Core S&P ETF is an exchange-traded fund incorporated in the USA. Th- e ETF tracks the performance of the S&P Index. It invests in all iShares Core S&P ETF. . . 1D. 1W. 1M. 3M. YTD. 1Y. 5Y. ALL. Why Robinhood mid-cap stocks selected by the S&P Committee. Index-Tracked. S&P TR USD. IVV | A complete iShares Core S&P ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF investing. It is managed by BlackRock Fund Advisors. It invests in public equity markets of the United States. The fund invests in stocks of companies operating across. The iShares Core S&P ETF is built to track the S&P Daily Total Return Index - USD. This ETF provides physical exposure - by owning its shares you. As a result, investors should think of this as a play on mega and large cap stocks in the American market. These securities are usually known as 'Blue Chips'. It is managed by BlackRock Fund Advisors. It invests in public equity markets of the United States. The fund invests in stocks of companies operating across. The returns shown do not represent the returns you would receive if you traded shares at other times. KEY FACTS. Fund Launch Date. 05/15/ Benchmark. S&P. iShares Core S&P ETF ; Price (USD) ; Today's Change / % ; Shares tradedm ; 1 Year change+%. Assess the IVV stock price quote today as well as the premarket and after hours trading prices. What Is the ishares S&P Ticker Symbol? IVV is the ticker. IVV: iShares® Core S&P ETF · ITOT: iShares® Core S&P Total U.S. Stock Market ETF. Volume, ; Exchange, DEUTSCHER KASSENVEREIN AG GRUPPE DEUTSCHE BOERSE ; ISIN, IE ; Fund Size (Mil) 15/08/, USD ; Share Class Size (Mil). iShares Core S&P ETF (IVV) is a passively managed U.S. Equity Large Blend exchange-traded fund (ETF). iShares launched the ETF in The investment seeks. About iShares Core S&P ETF BlackRock, Inc. IVV - one of several ETFs that track the S&P Index-delivers excellent large-cap exposure. Despite the. iShares Core S&P ETF. . . 1D. 1W. 1M. 3M. YTD. 1Y. 5Y. ALL. Why Robinhood mid-cap stocks selected by the S&P Committee. Index-Tracked. S&P TR USD. The iShares Core S&P ETF (the “Fund”) seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of. IVV ETF iShares Core S&P ETF. IVV, also known as the iShares Core S&P ETF, seeks to track the S&P index, which includes large-cap U.S. equities. In. Shareclass ticker. IVV. Data as of ; Shareclass name. iShares Core S&P ETF. % of fund assets screened ; Shareclass type. Exchange-traded funds (ETFs). Fund.

Compare Small Business Health Insurance Plans

Find a simple, cost-effective group benefits plan to stay competitive & engage your plan members, while helping them manage their health & wellness. Many small businesses struggle to offer health insurance to their workers, and the number of small businesses doing so has declined over time. Our plans for small to medium sized business help employers provide comprehensive coverage and service without compromising their budget. The Small Business Health Options Program (SHOP) helps small businesses with 1–50 employees provide private insurance to their employees. (employers) interested in viewing annual premium rates for the various small employer major medical health insurance plans currently available in Florida. All of our small business medical insurance plans feature integrated pharmacy coverage. Plans are designed to work seamlessly together so physicians and medical. Big Value For Small Businesses · Extended Health & Dental Coverage · Disability Coverage · Life & Critical Illness Coverage · Employee Wellness Coverage · Affordable. Level-funded plans can be a great solution for small employers because they provide the predictability of equal monthly payments throughout the year as well the. Best Health Insurance Companies for Small Businesses for September · Our Top Picks · Blue Cross Blue Shield · Kaiser Permanente · UnitedHealthcare · Aetna. Find a simple, cost-effective group benefits plan to stay competitive & engage your plan members, while helping them manage their health & wellness. Many small businesses struggle to offer health insurance to their workers, and the number of small businesses doing so has declined over time. Our plans for small to medium sized business help employers provide comprehensive coverage and service without compromising their budget. The Small Business Health Options Program (SHOP) helps small businesses with 1–50 employees provide private insurance to their employees. (employers) interested in viewing annual premium rates for the various small employer major medical health insurance plans currently available in Florida. All of our small business medical insurance plans feature integrated pharmacy coverage. Plans are designed to work seamlessly together so physicians and medical. Big Value For Small Businesses · Extended Health & Dental Coverage · Disability Coverage · Life & Critical Illness Coverage · Employee Wellness Coverage · Affordable. Level-funded plans can be a great solution for small employers because they provide the predictability of equal monthly payments throughout the year as well the. Best Health Insurance Companies for Small Businesses for September · Our Top Picks · Blue Cross Blue Shield · Kaiser Permanente · UnitedHealthcare · Aetna.

Discover small business health insurance plans that work as hard as your employees. Find medical coverage for businesses of employees at BCBS. Business owners can offer their employees one plan or a selection of plans to choose from. Small employers (generally those with employees) may be eligible. Are you looking for small group employer coverage? We offer health insurance to South Dakota and Iowa businesses with employees. Browse our plans and reach. Step 1: Evaluate your small business' health insurance needs · Step 2: Explore small business health insurance plan options · Step 3: Research additional features. Learn more about our benefits and insurance plans to see which solution could be right for your business. Workers, on average, paid $6, toward the cost of the coverage. That means businesses covered 73% of costs. Specifically looking at small businesses. This tool provides an easy way to compare health insurance quotes for individual health plans. Individual health insurance plans are policies you buy on. Florida Blue offers affordable small business group insurance plans with access to top providers. Learn more about our health plan options for small. eHealth works with a large variety of small business health insurance companies and has many plans to choose from in many states. eHealth can help you compare. na-sutki-39.ru has a tool to help compare costs when coverage is provided via a Small Group Plan, an Individual Coverage Health Reimbursement Arrangement (ICHRA). Emergency medical travel coverage; And more Find the SureHealth™ insurance plan that's right for you. Compare Plans. If you're looking for coverage for you and/or your family or you work for a small business and you're looking for coverage through your employer, this Plan. The best way to find out if you qualify for financial help and what plans Group health insurance for small business owners. If you are interested in. Fully Insured Plans. Get our full suite of health insurance plans. ; Balanced Funding Plans. The best blend of self-funding and full coverage. Available for. Blue Cross and Blue Shield of Texas can help you select between our flexible PPO and HMO health plans for small businesses based on your budget and needs. The cost of small business health insurance will depend on the type of plan you want to provide (ex. PPO, HMO). When comparing plans, consider premiums, out. Find the best health plan solution for your small business. Compare plans for a complete set of medical options and view plan rates. Small employers (generally those with employees) may be able to enroll in Small Business Health Options Program (SHOP) plans through an insurance company. The cost of small business health insurance, also known as small group health insurance, will depend on the type of plan or plans provided by your business. We offer the best small business health insurance plans that are flexible and affordable. Our plans aim to deliver enhanced benefits for you and your employees.

Scholarshare 529 Vs Vanguard 529

Compare college savings plans. You get more with The Vanguard Plan. Low costs, award-winning investments, and a high level of customer service. plans with QuickView. No more sorting through stacks of paper, fumbling through files, or waiting for the latest account information to be mailed. With. The Vanguard is more aggressive in the earlier years with more equities than ScholarShare , but then levels off later with more bonds. ScholarShare CA. CollegeInvest Direct Portfolio College Savings Plan The Vanguard College Savings Plan. NV. USAA College Savings Plan. NV. New. Vanguard. Our most popular plan, managed by Vanguard, with a choice of or other benefits or the amount of such aid or benefits. You should consult. Transfer funds electronically from your bank account to Vanguard. This convenient, secure service is free and lets you log on to na-sutki-39.ru or call to. Overall, the ScholarShare plan has been a top-performing plan. The plan ranked 8th for the 1-year period ended December 31, , according to. California · ScholarShare California. Type: Direct Sold. Manager: TIAA Nevada · The Vanguard College Savings Plan. Nevada. Type: Direct Sold. If you're starting out with smaller contributions, we recommend California's ScholarShare College Savings Plan. There's no minimum investment amount, and. Compare college savings plans. You get more with The Vanguard Plan. Low costs, award-winning investments, and a high level of customer service. plans with QuickView. No more sorting through stacks of paper, fumbling through files, or waiting for the latest account information to be mailed. With. The Vanguard is more aggressive in the earlier years with more equities than ScholarShare , but then levels off later with more bonds. ScholarShare CA. CollegeInvest Direct Portfolio College Savings Plan The Vanguard College Savings Plan. NV. USAA College Savings Plan. NV. New. Vanguard. Our most popular plan, managed by Vanguard, with a choice of or other benefits or the amount of such aid or benefits. You should consult. Transfer funds electronically from your bank account to Vanguard. This convenient, secure service is free and lets you log on to na-sutki-39.ru or call to. Overall, the ScholarShare plan has been a top-performing plan. The plan ranked 8th for the 1-year period ended December 31, , according to. California · ScholarShare California. Type: Direct Sold. Manager: TIAA Nevada · The Vanguard College Savings Plan. Nevada. Type: Direct Sold. If you're starting out with smaller contributions, we recommend California's ScholarShare College Savings Plan. There's no minimum investment amount, and.

This can be just about anybody, including parents, grandparents, other relatives and friends. Beneficiary: The future student, or person the College Savings. Managing your ScholarShare account. When it comes to making a financial decision, it's important to ask questions. Here are the answers to some of our. Vanguard Real Estate Index Fund, %. MWTSX, MetWest Total Return Bond Fund The information provided does not take into account the specific objectives or. This convenient, free-to-use service lets you contribute to a student's college savings plan account. For more information or to log in, visit Ugiftcom. TIAA-CREF manages ScholarShare (California), where residents of any state are welcome. California does not offer a state tax deduction for contributions to. • ScholarShare (California). • SMART (West Virginia). • SMART Select I really like the Vanguard funds used, very low fees and good historical. or other benefits that are only available for investments in that state's plan. The Vanguard Group, Inc., serves as the Investment Manager. ScholarShare Colorado. CollegeInvest Direct. Colorado. Scholars Choice The Vanguard College Savings Plan. Nevada. USAA College Savings Plan. Vanguard. Our most popular plan, managed by Vanguard, with a choice of or other benefits or the amount of such aid or benefits. You should consult. ScholarShare expenses are less than half the national average for plans. You pay no sales charges, start up or maintenance fees. The plan from. Vanguard Real Estate Index Fund, %. TBIIX, Nuveen Bond Index Fund, The information provided does not take into account the specific objectives or. Contributions up to $18, annually are not subject to the federal gift tax In a , you can combine 5 years worth of contributions, or $90, ScholarShare Colorado. CollegeInvest Direct. Colorado. Scholars Choice The Vanguard College Savings Plan. Nevada. USAA College Savings Plan. What is a Plan? A college savings plan is a popular tax-advantaged program that helps families save for higher education expenses.1 A family member or. Welcome to Nevada's College Savings Plans · Explanation of various plans · Future Path Plan · Vanguard Plan · USAA Plan · Putnam for America. Arkansas. iShares Plan. Arkansas Brighter Future Plan. Arizona. Goldman Sachs Plan. California. ScholarShare Colorado. CollegeInvest Direct. ScholarShare account, either new or existing. Eligible public school For more information about the ScholarShare College Savings Plan, visit. The Vanguard cost advantage · Expense ratios for The Vanguard Plan portfolios: · Fees you won't pay at Vanguard: · Want to roll over money you have in. California's ScholarShare is available to residents of any state. It offers a variety of investment options from TIAA-CREF, T. Rowe Price, Vanguard and.

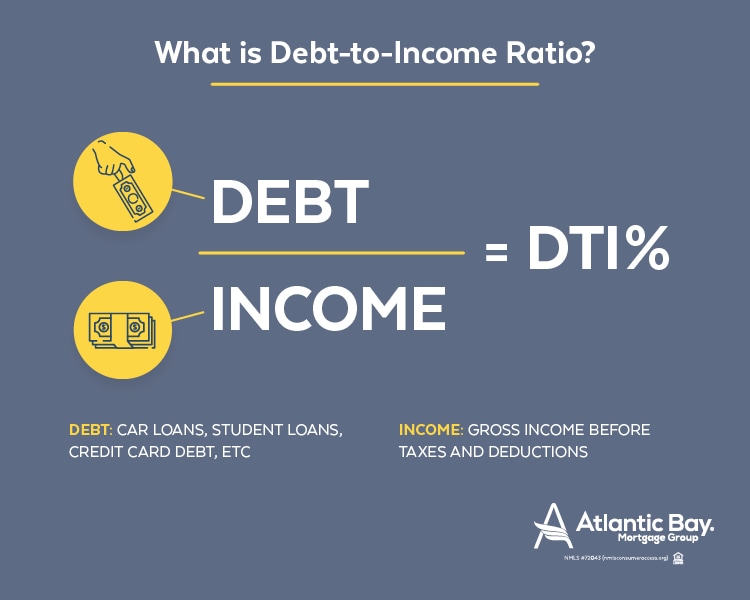

What Is Debt To Income Ratio For A Home Loan

According to a breakdown from The Mortgage Reports, a good debt-to-income ratio is 43% or less. Many lenders may even want to see a DTI that's closer to 35%. Your debt-to-income ratio reflects how much of your income is taken up by debt payments. · Understanding your debt-to-income ratio can help you pay down debt and. It is calculated by dividing your total recurring monthly debt by your gross monthly income(s) (monthly income(s) before taxes or other deductions). A debt-to-income (DTI) ratio looks at how much debt you have in relation to your total annual income before tax. Most conventional loan underwriting conditions limit DTI to 45%, but some QM lenders will accept ratios up to 50% if the borrower has compensating factors, such. Lenders prefer a front-end ratio of 28% or less for conventional loans and 31% or less for Federal Housing Association (FHA) loans. For the back-end ratio, many. As a general rule of thumb, it's best to have a debt-to-income ratio of no more than 43% — typically, though, a “good” DTI ratio is below 35%. If you're applying for a personal loan, lenders typically want to see a DTI that is less than 36%. They might allow a higher DTI, though, if you also have good. A debt-to-income, or DTI, ratio is calculated by dividing your monthly debt payments by your monthly gross income. According to a breakdown from The Mortgage Reports, a good debt-to-income ratio is 43% or less. Many lenders may even want to see a DTI that's closer to 35%. Your debt-to-income ratio reflects how much of your income is taken up by debt payments. · Understanding your debt-to-income ratio can help you pay down debt and. It is calculated by dividing your total recurring monthly debt by your gross monthly income(s) (monthly income(s) before taxes or other deductions). A debt-to-income (DTI) ratio looks at how much debt you have in relation to your total annual income before tax. Most conventional loan underwriting conditions limit DTI to 45%, but some QM lenders will accept ratios up to 50% if the borrower has compensating factors, such. Lenders prefer a front-end ratio of 28% or less for conventional loans and 31% or less for Federal Housing Association (FHA) loans. For the back-end ratio, many. As a general rule of thumb, it's best to have a debt-to-income ratio of no more than 43% — typically, though, a “good” DTI ratio is below 35%. If you're applying for a personal loan, lenders typically want to see a DTI that is less than 36%. They might allow a higher DTI, though, if you also have good. A debt-to-income, or DTI, ratio is calculated by dividing your monthly debt payments by your monthly gross income.

FHA home loans: Front-end ratio – 31% | Back-end ratio – 43% · USDA home loans: Front-end ratio – 29% | Back-end ratio – 41% · VA home loans: No front-end ratio. A lender will want your total debt-to-income ratio to be 43% or less, so it's important to ensure you meet this criterion in order to qualify for a mortgage. Lenders generally prefer to see a DTI ratio of 43% or less. However, some may consider a higher DTI of up to 50% on a case-by-case basis. It's actually pretty simple. Just divide your monthly debt (car loan, student loan, personal loan, and minimum credit card payments) by your gross income. We'll. It is the percentage of your monthly pre-tax income you must spend on your monthly debt payments plus the projected payment on the new home loan. Simply put, the debt ratio compares your total debt to total assets. Your debt includes recurring monthly payments that you owe, such as credit card bills. This ratio, calculated as a percentage, is found by dividing your monthly debts by your gross monthly income (your total pay before taxes). AgSouth Mortgages Home Loan Originator Brandt Stone says, “Typically, conventional home loan programs prefer a debt to income ratio of 45% or less but it's not. Your debt-to-income ratio, also known as your back-end ratio, is also important. This ratio tells you how much of your monthly salary is eaten up by all of your. What Lenders Want to See with Your Debt-to-Income Ratio. We want your front-end ratio to be no more than 28 percent, while your back-end ratio (which includes. The DTI guidelines for the most common loan programs are as follows: Conventional loans: 50%, FHA loans: 50%, VA loans: 41%, USDA loans: 43%. The answer to this question will vary by lender, but generally, a debt-to-income ratio lower than 35% is viewed as favorable meaning you'll have the flexibility. Maximum DTI Ratios. For manually underwritten loans, Fannie Mae's maximum total DTI ratio is 36% of the borrower's stable monthly income. The maximum can be. The DTI ratio requirement is 41%. Conventional loans. Conventional mortgage loans are the most common type of mortgage. The DTI ratio for conventional loans may. Debt Ratios For Residential Lending. Lenders use a ratio called "debt to income" to determine the most you can pay monthly after your other monthly debts are. To calculate your DTI for a mortgage, add up your minimum monthly debt payments then divide the total by your gross monthly income. For example: If you have a. A debt-to-income ratio (DTI) is expressed as a percentage, showing how much of your total monthly income goes toward debt payments each month. Total monthly debts are $ (auto loan) + $ (student loans) + $1, (mortgage) = $1, · Total monthly gross income = $4, · $1, / $4, = · This. Debt-to-income ratio of 36% to 41% DTIs between 36% and 41% suggest that you have manageable levels of debt in relation to your income. However, larger loans. Your debt-to-income ratio (DTI) is the percent of your gross monthly income that goes toward required debt payments. This number allows potential lenders to.

Web Designing Coaching

In this coaching community, you'll get personal coaching from me (Josh) and the support of the most amazing web design community online! Develop your skills with quick, hands-on guidance and deep dive into Web design Courses created by Wix Learn just for you! Join millions of learners and begin a web design course led by top rated instructors on Udemy, where you can learn to create beautiful websites. Find & compare hands-on Web Design courses near NYC or live online. We've chosen over 40 of the best Web Design courses from the top training providers. The Web Design Certificate will provide learners the ability to develop websites by learning how to design and code functional graphics. These free online Web Design courses will teach you everything you need to know about Web Design. Web design classes can cover the fundamentals of web design and web development. Learners can expect a deep dive into such topics as UX design, UI design, and. Get more with paid Web Design courses · Creating Responsive Web Design · Web Design for Beginners: Real World Coding in HTML & CSS · UX & Web Design Master Course. Learn everything from responsive web design, to WordPress design, and create user-friendly sites for yourself or for your web design business clients. In this coaching community, you'll get personal coaching from me (Josh) and the support of the most amazing web design community online! Develop your skills with quick, hands-on guidance and deep dive into Web design Courses created by Wix Learn just for you! Join millions of learners and begin a web design course led by top rated instructors on Udemy, where you can learn to create beautiful websites. Find & compare hands-on Web Design courses near NYC or live online. We've chosen over 40 of the best Web Design courses from the top training providers. The Web Design Certificate will provide learners the ability to develop websites by learning how to design and code functional graphics. These free online Web Design courses will teach you everything you need to know about Web Design. Web design classes can cover the fundamentals of web design and web development. Learners can expect a deep dive into such topics as UX design, UI design, and. Get more with paid Web Design courses · Creating Responsive Web Design · Web Design for Beginners: Real World Coding in HTML & CSS · UX & Web Design Master Course. Learn everything from responsive web design, to WordPress design, and create user-friendly sites for yourself or for your web design business clients.

Introduction to HTML5. Course 1 · 11 hours ; Introduction to CSS3. Course 2 · 16 hours ; Interactivity with JavaScript. Course 3 · 9 hours ; Advanced Styling with. Take a design-first approach to Web development. Master industry Web Design classes also fulfill elective requirements of the following programs. Get the best online web design courses at Koenig Solutions. Gain website design certification through expert web design and development training. The above list of 25 best web design tutorials and Courses is a great resource for anyone looking for ways to streamline web design operations. We help women web designers stop undercharging and overdelivering, to create freedom, flexibility and financial independence as a freelance web designer. Find Top Paid & Free online Web Design courses, certifications, trainings, programs & specialization at Shiksha Online. Compare best Web Design courses. In this live Web Development course, learn to create beautiful, responsive websites by mastering the building blocks of the Web: HTML, CSS, and more. Free Web Design Courses · star. Trustpilot · star. Course Report · star. switchup · star. Career karma. Our comprehensive web designing courses offer hands-on training and expert guidance to help you develop the skills needed to build beautiful websites. Learn front-end development and graphic design skills to succeed in a career in web design with this web design course. Enroll today! Learn to design and develop dynamic and responsive websites in hands-on classroom and corporate training in New York. Learn web design with online courses and programs. Want to create user-friendly, dynamic websites? Modern web design involves understanding the technology. Our Web Design online training courses from LinkedIn Learning (formerly na-sutki-39.ru) provide you with the skills you need, from the fundamentals to advanced. We'll learn how to gather information, explore potential concepts, and iterate on a design. By the end, you'll have the foundation you need to continue your. The only course you need to become a full-stack web developer. Covers HTML5, CSS3, JS, ES6, Node, APIs, Mobile & more! I'd recommend doing The Odin Project Foundations course first, then there's an amazing course on Udemy about advanced CSS. Tech Altum is the best institute for web designing. I have completed my web designing coursefrom tech altum and also made a good project under guidance of. From the fundamentals to advanced topics — learn how to build sites in Webflow and become the designer you always wanted to be. The Web Design and Development Program, offered through Hofstra Continuing Education, gives you the roadmap to achieve technical and creative success.

1 2 3 4 5 6 7 8